Students get financial literacy upgrade

Credit union sponsors Banzai program in local schools

Originally posted on Chico Enterprise-Record and Oroville Mercury-Register

CHICO — Kristina Hahn has taught economics for 27 years. This semester, she’s introducing her students at Chico High School to a different way to develop financial literacy: a tech-aided curriculum designed with young people in mind.

The program is called Banzai, and it’s come to 12 north state schools — including Chico High and Pleasant Valley High School — under sponsorship from Members 1st Credit Union. The financial institution has conducted in-person workshops since 2011; the platform of Banzai (online at Banzai.org) broadened its outreach. Members 1st rolled out Banzai in 2017.

Hahn found the program while searching the internet for financial literacy curriculum. For her students shifting from a semester of government to a semester of econ, Hahn is set to sprinkle Banzai into her lesson plans.

“It looked like it had some realistic scenarios,” Hahn said of the curriculum’s interactive elements. “There’s a workbook, so there are activities that students can work their way through. It has some things that I had always been interested in teaching students, like about savings and the budgeting.”

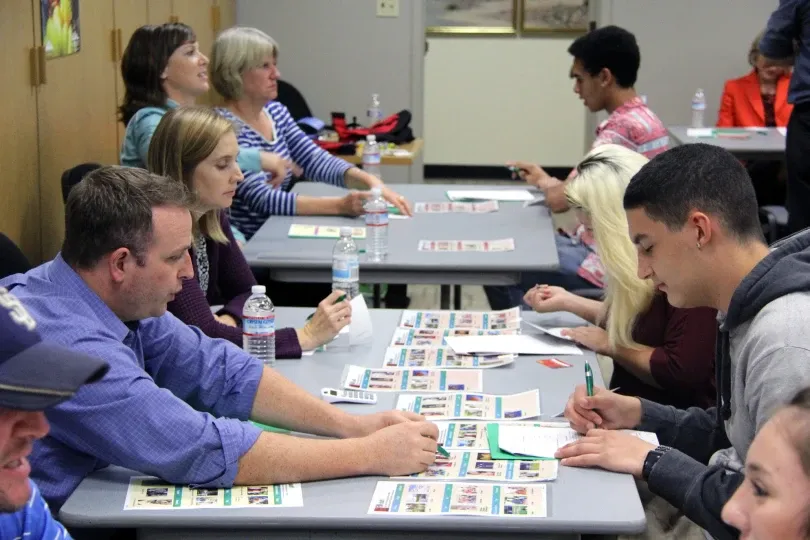

That’s the motivation for Members 1st, too. Josh Markle, vice president of marketing, said the credit union launched Banzai locally to promote a better understanding of money matters among youth heading into adulthood. Since 2014, Members 1st has conducted a financial literacy program called Bite of Reality, the evolution of an educational effort that started three years earlier.

“It’s something that’s certainly near and dear to our heart as a credit union and an overall scope of financial wellness that we’re not just trying to provide to our members but to the communities that we serve as well,” Markle said. “The (Bite of Reality) program was fantastic, but there came to a spot where the scalability was holding us back a bit. As dedicated as the group of volunteers that we had for that in-person program were, there’s only so much time in the day where we can pull together that group and administer the program.”

Members 1st found other credit unions using Banzai, he continued, “and it seemed like a great way for us to expand our program and get it into some of the schools, which at the time had been one of the focuses for us, too.”

How it works

Members 1st has gotten Banzai to 36 teachers and 2,200 students in Butte, Shasta and Tehama counties. Markle said it’s too soon to gauge the impact on spending and saving habits, but the credit union has been encouraged by the feedback it’s received from participants.

Banzai incorporates gameplay and life lessons into a format conducive to individualized instruction. Students proceed at their own pace, guided and aided by the teacher. They learn money management and get exposed to dilemmas they’ll face as independent adults, if they haven’t already.

Should they splurge on a trip or save for a new car? Can they afford coffee-house drinks daily, or occasionally?

Such decision points emerge in the 90-minute Bite of Reality sessions and throughout Banzai.

“For us, it was really stepping into a void,” Markle said. “We had teachers that were interested in providing this information, but there was this obstacle of ‘OK, let me build my curriculum’ or find something another teacher has done before. This really alleviated that challenge.”

Hahn, like others who teach economics, incorporates a unit of financial literacy into her classes. She anticipates the Banzai program enhancing those discussions.

“It’s really important to start talking about this early,” Hahn said. “Some of these things are hard to conceptualize before you actually have to do it: car insurance and saving and budgeting and so on.

“And the students, when we do financial literacy lessons, they enjoy that — the practical, realistic nature.”