Meet the Banzai Coach

Banzai is proud to announce a brand-new, financial education solution for adults that has no peer or precedent: the Banzai Coach.

Virtual Financial Adviser

The bread and butter of our simulation courses — Junior, Teen, and Plus — has always been their interactivity. Kids in schools love knowing that their decisions in the game actually have an impact — it feels grown up. As adults, we have quite the opposite concern: just about every decision we make has some kind of impact we didn’t predict or control. That’s why account holders want guidance that’s reasonable, nonjudgmental, and easy to understand.

The Coach is a virtual financial adviser that blends interactivity with real numbers.

The Coach is part of the Banzai Direct suite, and it’s called the Coach for a reason — it helps adults realize their financial goals, discipline their thinking, and take responsibility for their future.

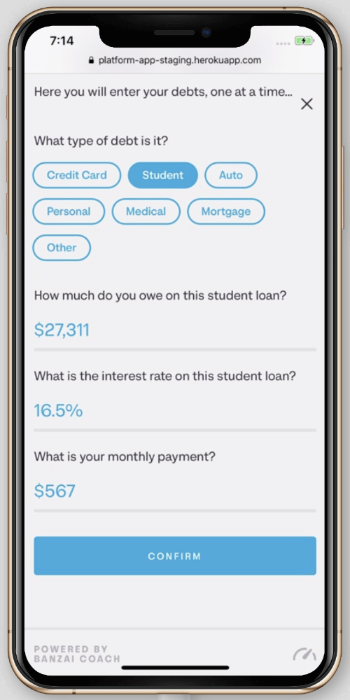

Get Out of Debt

Many adults struggle to manage their personal debt, and the need for adult education in this area almost goes without saying. This particular Coach session offers perspective and advice to users who want a clear picture of their situation and a way to manage it.

Users learn how to:

- assess their debts comprehensively;

- gain perspective on minimum payments and interest; and,

- weigh the advantages of the debt snowball and the debt avalanche methods.

When appropriate, this Coach session refers users to our partner, GreenPath Financial Wellness, to further assess their financial health and enroll qualifying individuals in a debt management plan.

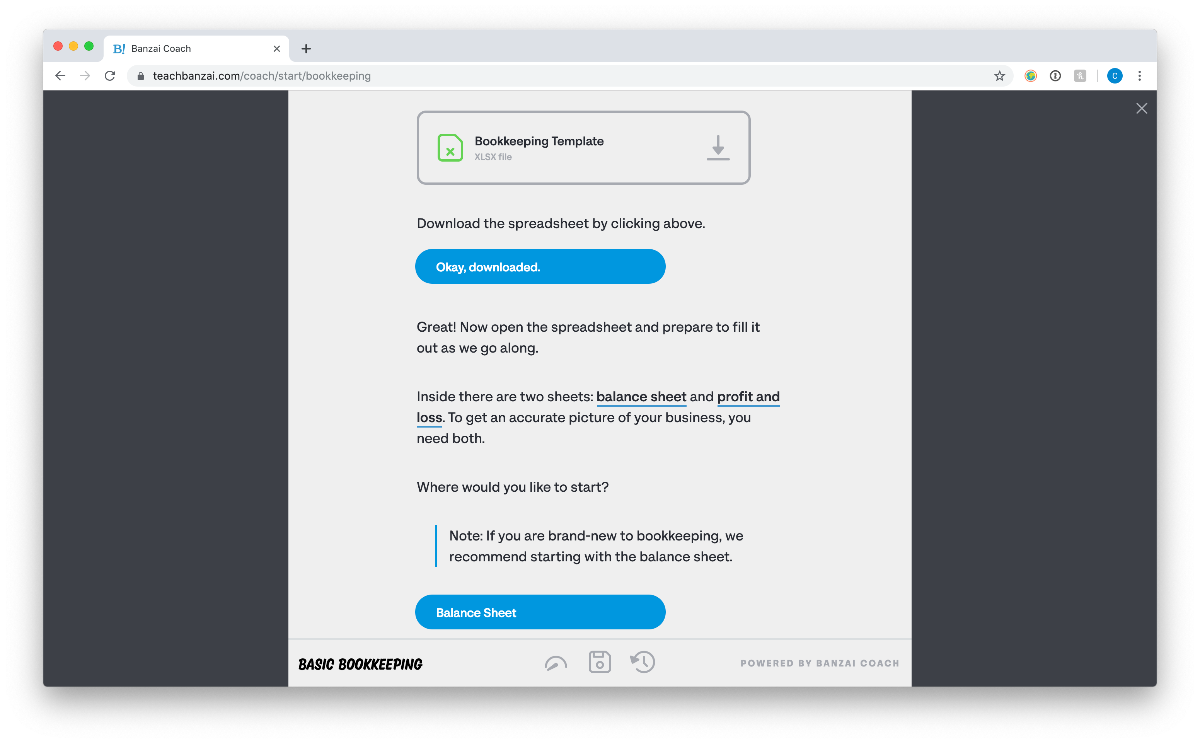

Basic Bookkeeping

This session is specific to business account holders. While each session asks questions and responds to feedback, in this case, the session gives users a template and teaches them to use it!

Users learn how to:

- create basic financial reports;

- calculate straight-line depreciation of assets; and,

- use simple ratios to analyze profitability.

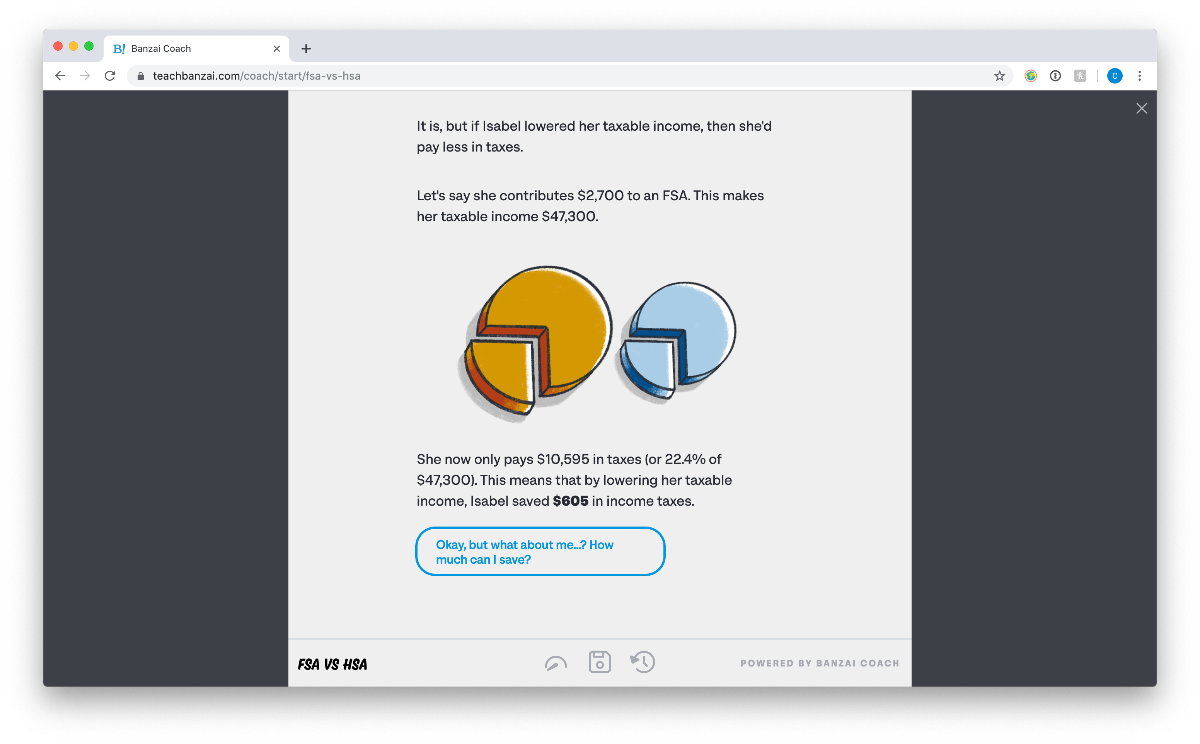

Make the Most of Your HSA or FSA

This session creates a unique recommendation based on user information: a suggested contribution for a health savings account (HSA) or flexible spending account (FSA). Both accounts are governed by different rules, which means they carry different benefits and trade-offs.

Users learn how to:

- understand the difference between HSAs and FSAs;

- contribute amounts that fit their expected expenses; and,

- accurately project how much money they’d save on taxes.

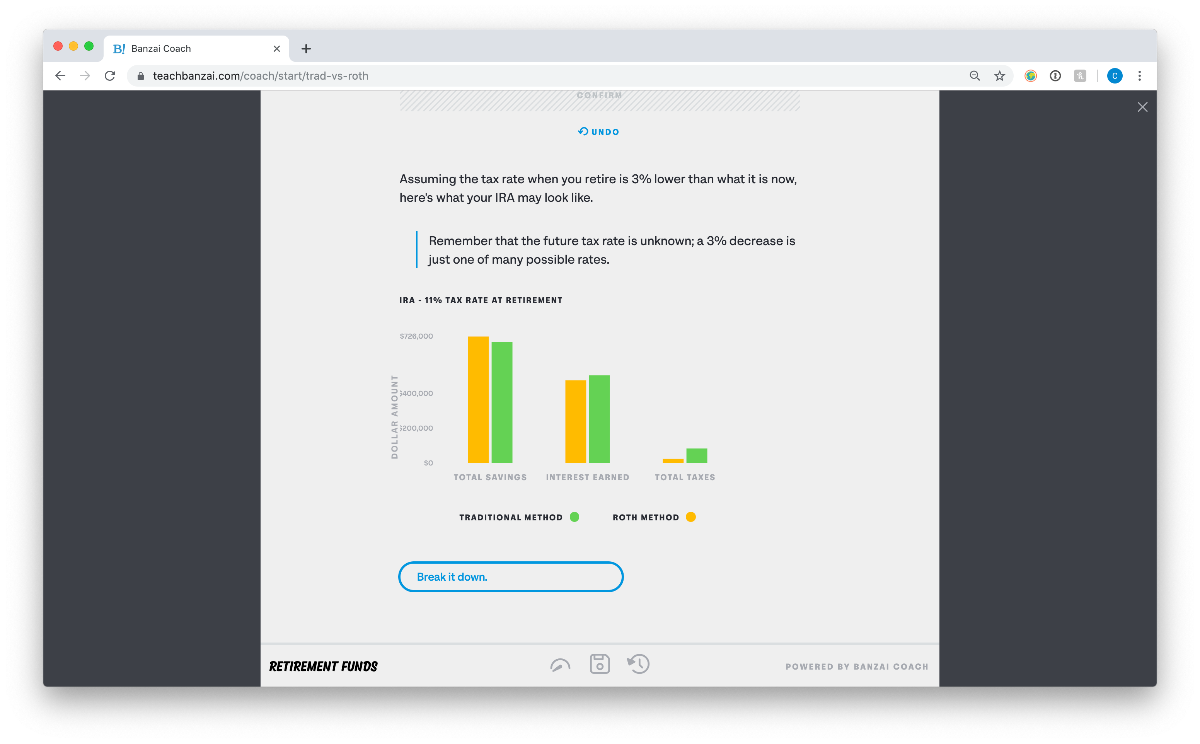

Retirement Funds

Employees entering the workforce are often confronted with a decision between a Roth or Traditional retirement account, having no idea what either of those means for their savings. This Coach session shines a light on that mystery by estimating a user’s savings based on current and potential future tax rates.

Users learn how to:

- understand the difference between Roth and traditional retirement funds;

- predict how much their retirement savings will grow; and,

- test different values for future retirement outcomes.

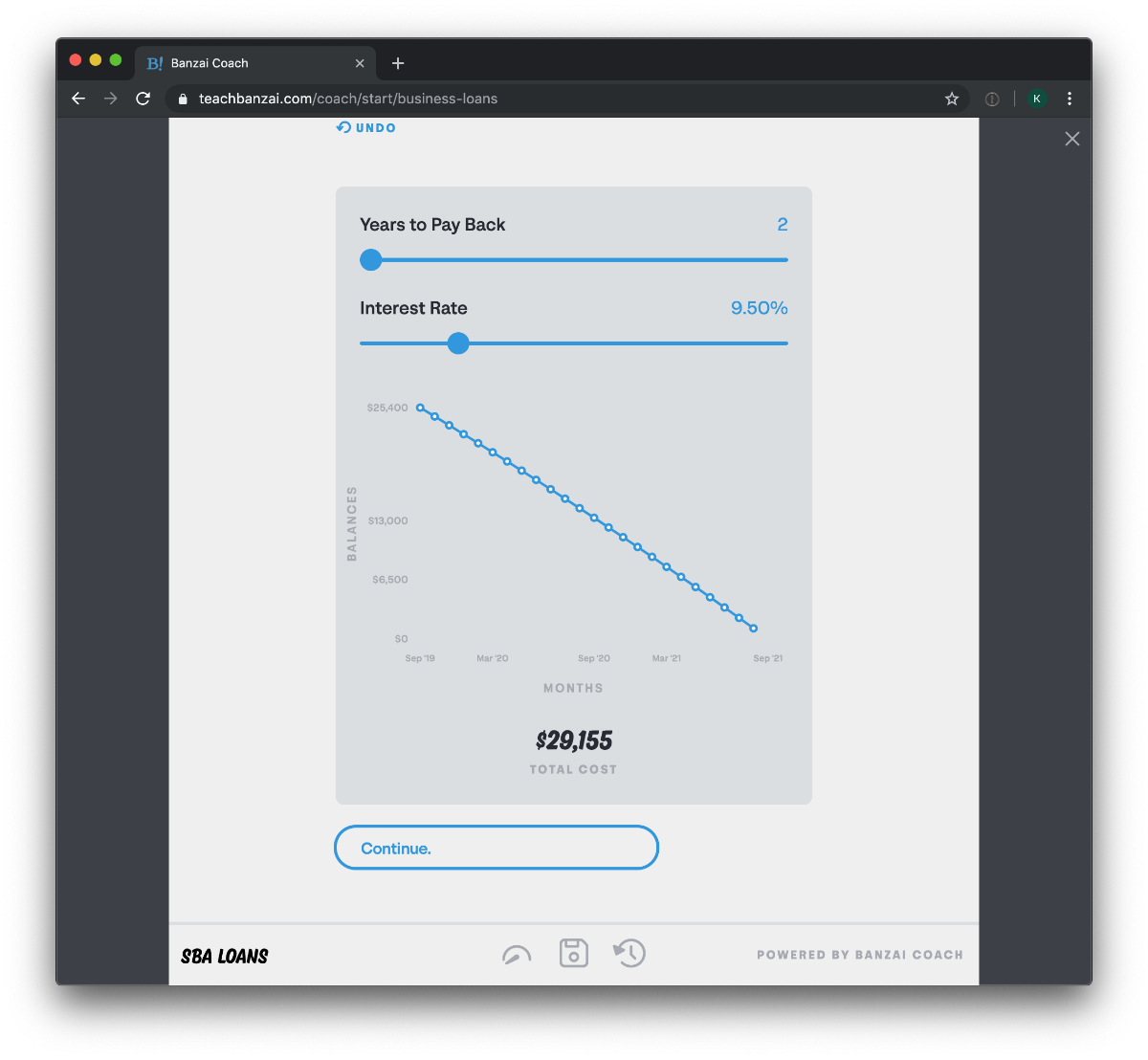

Your First SBA Loan

Your average entrepreneur won’t know that the SBA accommodates micro-loans as well as loans up to $5 million ($10 million for CDC loans). The Coach addresses these and many other nuances, helping users understand what type of loan is right for their business and how to prepare for it.

Users learn how to:

- calculate how much they need to borrow for their business;

- understand SBA loans; and,

- apply for an SBA loan through financial institutions.

The Coach asks sophisticated questions and gives sophisticated answers.

Financial institutions now have a robust tool in the Banzai Direct suite that completely disrupts their customers’ expectations. Organizations that want to know how to use the Banzai Coach in their financial literacy efforts should email partners@teachbanzai.com or call 888.822.6924 to set up a product demo.